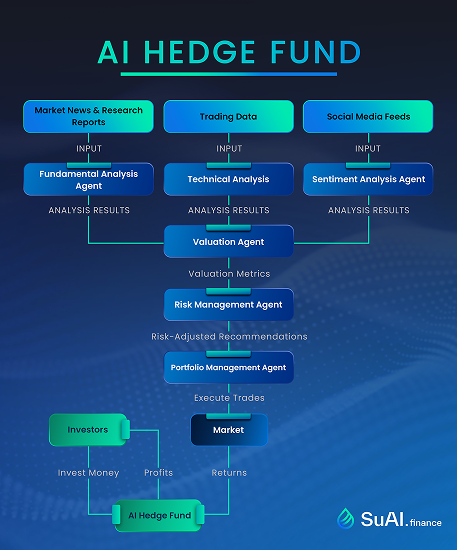

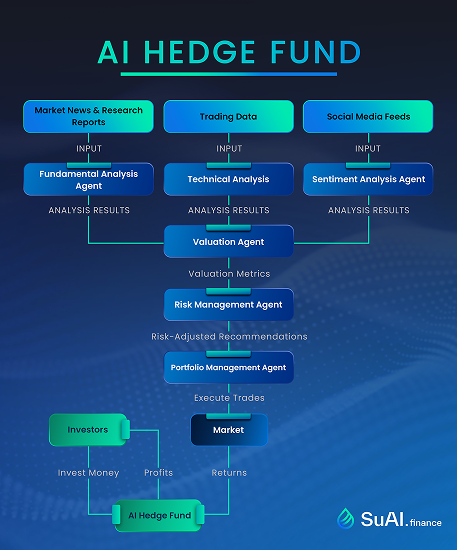

AI HEDGE FUND

AI Agentic Finance Hedge Fund

The powered by SUI Blockchain

Watch how How SuAI works

AI Agent Framework

Solution

Multiple autonomous AI agents interact simultaneously in concert without traditional blockchain bottlenecks to identify, analyze, and execute trading opportunities across digital asset markets.

Market Analysis Agents

Pattern Recognition Agent

Identifies technical patterns and market microstructure

Sentiment Analysis Agent

Processes news and social media data

On-chain Analytics Agent

Monitors blockchain metrics and wallet movements

Volatility Prediction Agent

Forecasts price volatility and market risk

Portfolio Management Agents

Risk Management Agent

Monitors portfolio exposure and implements stop-loss mechanisms

Position Sizing Agent

Determines optimal position sizes based on risk parameters

Rebalancing Agent

Maintains target portfolio allocations

Liquidity Management Agent

Ensures efficient capital deployment across exchanges

Execution Agents

Order Execution Agent

Implements smart order routing and execution algorithms

Slippage Optimization Agent

Minimizes trading costs and market impact

Exchange Selection Agent

Routes orders to optimal venues based on liquidity and fees

The triplet of high performance, built-in security, and rich type system for complex multi-agent systems in a complex financial world

Architecture

How SuAI works (System Architecture)

Manage investment strategies autonomously.

Data Collection Layer

- Real-time market data ingestion from multiple cryptocurrency exchanges

- On-chain data collection from blockchain networks

- Social sentiment analysis from crypto-specific news sources and social media

- Market depth and order book data streams

- Transaction flow analysis from major wallets and exchanges

Risk Management Framework

Market Risk Controls

- Dynamic position sizing based on volatility

- Real-time drawdown monitoring

- Correlation analysis across crypto assets

- Automated circuit breakers for extreme market conditions

Operational Risk Controls

- Exchange counterparty risk limits

- Smart contract risk assessment

- Multi-signature wallet implementation

- Cold storage integration for majority of assets

Performance Monitoring

Key Metrics

- Sharpe Ratio target: >2.0

- Maximum drawdown limit: 15%

- Daily VaR calculations

- Exchange exposure limits

- Rolling correlation monitoring

Operational Risk Controls

- Exchange counterparty risk limits

- Smart contract risk assessment

- Multi-signature wallet implementation

- Cold storage integration for majority of assets

Create an autonomous hedge fund for trading assets by leveraging power of AI agents.

Tech Stack

Technology Stack

Automates portfolio management, risk assessment, and market analysis.

Core Infrastructure

- Cloud-based infrastructure (AWS/GCP)

- High-frequency data processing capabilities

- Redundant system architecture

- Real-time monitoring and alerting

Security Measures

- Multi-factor authentication

- API key rotation

- Network security protocols

- Regular security audits

Create an autonomous hedge fund for trading assets by leveraging power of AI agents.

AI Agent Framework

Solution

Multiple autonomous AI agents interact simultaneously in concert without traditional blockchain bottlenecks to identify, analyze, and execute trading opportunities across digital asset markets.

Market Analysis Agents

Pattern Recognition Agent

Identifies technical patterns and market microstructure

Sentiment Analysis Agent

Processes news and social media data

On-chain Analytics Agent

Monitors blockchain metrics and wallet movements

Volatility Prediction Agent

Forecasts price volatility and market risk

Portfolio Management Agents

Risk Management Agent

Monitors portfolio exposure and implements stop-loss mechanisms

Position Sizing Agent

Determines optimal position sizes based on risk parameters

Rebalancing Agent

Maintains target portfolio allocations

Liquidity Management Agent

Ensures efficient capital deployment across exchanges

Execution Agents

Order Execution Agent

Implements smart order routing and execution algorithms

Slippage Optimization Agent

Minimizes trading costs and market impact

Exchange Selection Agent

Routes orders to optimal venues based on liquidity and fees

The triplet of high performance, built-in security, and rich type system for complex multi-agent systems in a complex financial world

Architecture

How SuAI works (System Architecture)

Manage investment strategies autonomously.

Data Collection Layer

- Real-time market data ingestion from multiple cryptocurrency exchanges

- On-chain data collection from blockchain networks

- Social sentiment analysis from crypto-specific news sources and social media

- Market depth and order book data streams

- Transaction flow analysis from major wallets and exchanges

Risk Management Framework

Market Risk Controls

- Dynamic position sizing based on volatility

- Real-time drawdown monitoring

- Correlation analysis across crypto assets

- Automated circuit breakers for extreme market conditions

Operational Risk Controls

- Exchange counterparty risk limits

- Smart contract risk assessment

- Multi-signature wallet implementation

- Cold storage integration for majority of assets

Performance Monitoring

Key Metrics

- Sharpe Ratio target: >2.0

- Maximum drawdown limit: 15%

- Daily VaR calculations

- Exchange exposure limits

- Rolling correlation monitoring

Operational Risk Controls

- Exchange counterparty risk limits

- Smart contract risk assessment

- Multi-signature wallet implementation

- Cold storage integration for majority of assets

Create an autonomous hedge fund for trading assets by leveraging power of AI agents.

Tech Stack

Technology Stack

Automates portfolio management, risk assessment, and market analysis.

Core Infrastructure

- Cloud-based infrastructure (AWS/GCP)

- High-frequency data processing capabilities

- Redundant system architecture

- Real-time monitoring and alerting

Security Measures

- Multi-factor authentication

- API key rotation

- Network security protocols

- Regular security audits

Create an autonomous hedge fund for trading assets by leveraging power of AI agents.

Tokenomics

SuAI Finance

Smart contract-based governance ensures all operations adhere to predefined parameters, maintaining full auditability and compliance

01

Holders drive to key decisions, earn rewards

02

Access top Defi assets and opportunities

03

Simple & intuitive tools - making advance strategies easy for all

Blockchain

Sui Network

Total token Supply

1,000,000,000

Token Type

Governance & Utility

Category

DefAI

Raise type

Community / Opens

Partners and Supporters

Why SUI for SuAI?

Sui is the only L1 blockchain that offers a unique approach to parallel execution and object-centric architecture for truly scalable AI agent interactions. Several AI agents in SuAI collaborate to find opportunities in DeFi protocols. SuAI agents execute trades and manage yields while adhering to strict risk management rules.

Implementation Timeline

Phase

01

Infrastructure setup

Data collection system implementation

Basic agent framework development

Phase

02

Agent training and optimization

Risk management system implementation

Paper trading and backtesting

Phase

03

Live trading with limited capital

Performance monitoring refinement

System optimization

Phase

04

Full-scale deployment

Advanced strategy implementation

Investor onboarding process